Tag: garrett

Garrett County Fair

If you are in Deep Creek Lake from July 30 – August 6, you are in luck! The Garrett County Fair will be held right here on Mosser Road in McHenry, Maryland. Offering rides, agricultural contests, vendors of all kinds, and much more, the fair is not something to miss!

For more information, click on the photo.

Friendsville Days

The 36th Annual Friendsville Days will be held from July 29th & 30th. Come visit the small, charming town for all kinds of activities. There will be a parade, vendors, entertainment and more!

For more information, click on the photo.

Bill's Marine Service

Check out one of Deep Creek Lake’s local marinas! Bill’s Marine Service has been around Deep Creek for over 40 years. They are a full service marina offering new and pre-owned boat sales, rentals, service, and storage.

If you are here on vacation and looking to rent, Bill’s Marine Service offers ski, pontoon and fishing boat rentals.

For more information, click on the photo.

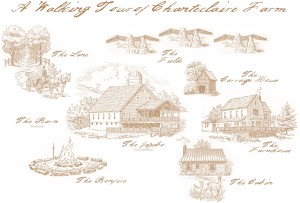

Chanteclaire Farm

Looking for a beautiful wedding venue near Deep Creek Lake? Check out Chanteclaire Farm. Located off the beautiful Friendsville Road, Chanteclaire Farm offers a serene setting, perfect for a wedding.

The farm is only a ten minute drive away from Deep Creek Lake!

But don’t just take my word for it- check out their website by clicking on the photo.

Deep Creek Lavender Farm

Looking for a unique place to visit during your Deep Creek Lake vacation? Try Deep Creek Lavender Farm. Located in Accident, Maryland, it is a short drive from the lake.

The farm has over 1,200 lavender plants, including many different species. They offer many kinds of lavender products and lunches for guests that request them in advance. The farm is open every Saturday, Sunday and Monday, starting after Memorial Day.

For more information, click on the photo.

Accident Fourth of July Homecoming

Head to Accident, Maryland for 4th of July activities! Starting at 9 am, the town will be rocking all day long and into the night. There will be food, fun and festivities for all!

For more information, click on the photo.

4th Annual Deep Creek Lake Boat Parade

The Deep Creek Lake Lions Club will be hosting the 4th Annual Deep Creek Lake Boat Parade on July 2nd! Starting around 7 p.m., the boats will begin at the Deep Creek Marina Lakeside Club (in McHenry Cove) and sail to Silver Tree.

This event cannot be missed! Whether you are planning to view the boat parade or register your boat to be in it, it will be a great time. The Boardwalk, Lakeside Creamery, Uno’s & the Honi-Honi Bar are just a few fun places to view the event.

For more information, click here.

Taylor-Made Deep Creek Vacations & Sales- A One Stop Shop

Taylor-Made Deep Creek Vacations and Sales is here to provide Deep Creek Lake residents with superb service.

We do a lot! From rentals to real estate to property management, you might not realize all the things we can do to help you!

Check out some things you may not have known about Taylor-Made!

We provide…

Hot Tub Service

Lawn Care

Dock Services

Emergency Visits

Firewood

Gutter Cleaning

Bug Extermination

Carpet Cleaning

Security Checks

Housekeeping Services

Mulching

Yard Clean-up

Snow Removal

Window Cleaning

Minor Construction

Painting

These services are available to homes around Deep Creek Lake. You do not need to rent from us to be part of the Taylor-Made family!

GIVE US A CALL TODAY AND LET US KNOW HOW WE CAN BEST SERVE YOU AND YOUR HOME AWAY FROM HOME!

Please contact us at 1-866-351-1119 or email us at info@deepcreekvacations.com.

June 2016 Lakefront Listings

Summer is finally here! With the warm weather, comes boating season at Deep Creek Lake.

If your lakefront vacation rental is causing you to fall in love with Deep Creek Lake, then take a glance at some of my lakefront and lake access listings.

This paradise could be yours! Click on the photos for more information.

To see all lakefront listings, click here.

To see all my listings, on and off the lake, click here.

PRICE REDUCTION- 1135 & 1137 Boy Scout Rd

Check out this listing of mine! Two houses for one.

Truly a unique property!

Click on the photo for more.

←

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

...

44

45

46

→